Tall buildings, an illuminated skyline, the Marina Bay Sands hotel.

When you think of Singapore, what’s the first thing you think about?

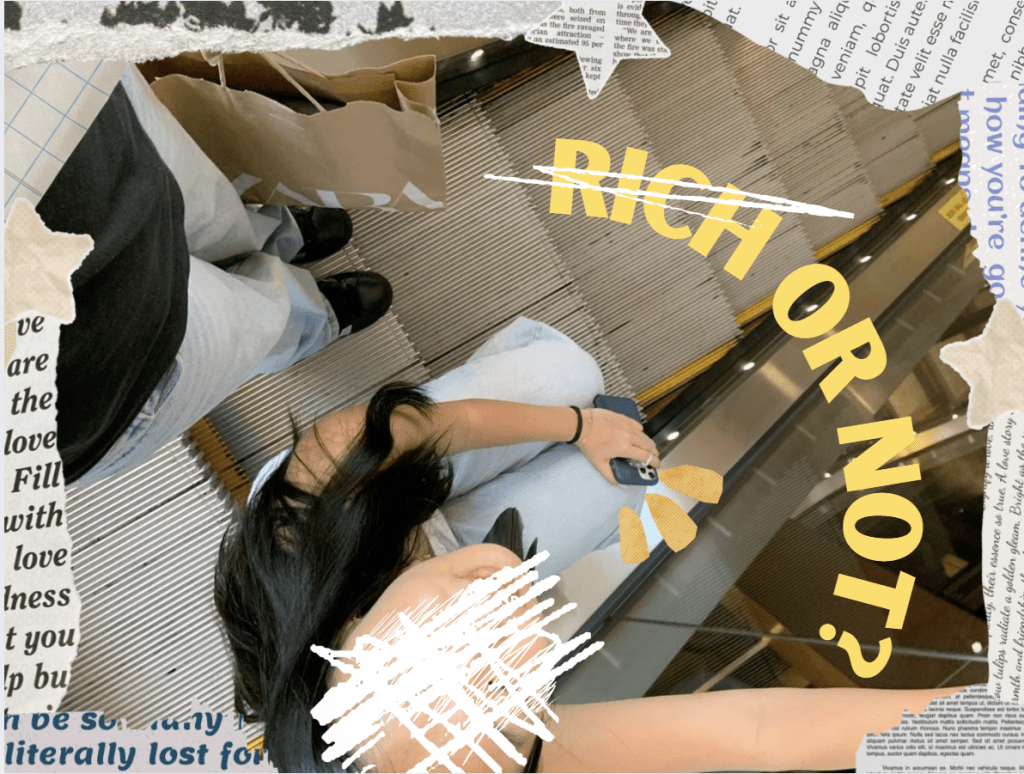

People tend to perceive Singapore as this radiant bustling city full of economic opportunities, where families indulge in grand feasts while enjoying the outstanding views of Orchard through tinted lenses. Where you host extravagant weddings adorned with bright red hong baos brimming with money. Just like in “Crazy Rich Asians”, right?

And that is true to some extent. In 2025, Singapore was ranked 4th for nominal GDP per capita according to the IMF. Its population is undeniably wealthy – that is if we’re looking at it like a flat single sheet of paper. On the surface, Singapore’s one of those countries that just screams “rich”. However, with a rapidly increasing economy, the cost of living has substantially skyrocketed in the past decade.

When calculating expenses, families pile up on rent, groceries and personal expenses; the result is a monthly spending far exceeding the reasonable amount. Let’s put this into perspective.

Singapore’s property prices are relatively high in comparison to other nations, notably in the Asia-Pacific region where it ranks the highest surpassing HongKong as the most expensive market. Other nations’ housing index fell considerably when struck with the covid-19 pandemic in 2022, whereas Singapore’s increased by 8 percent. Why is this happening? Singapore is small and densely populated – owning land is competitive which drives up property prices.

This growth is causing a significant misalignment with living costs and the general population’s ability to keep up. Groceries are unusually costly because everything is branded and labelled: bio, gluten-free, grass fed.

So, yes. Singapore’s population is wealthy in comparison to that of many other nations in the Asia-Pacific region, but this wealth is requisite to the costs of living. What appears as excess is often equilibrium.

But this raises a question: what happens to those who don’t meet the “wealthy threshold”

Many Singaporeans, especially lower- to middle-income families, face a persistent struggle to keep pace with the rising costs. While wages have grown, they haven’t always climbed fast enough to match inflation, rental spikes, and increasing everyday expenses. Their version of Singapore is not the same as rooftop bars and infinity pools but rather budgeting apps and postponed staycations.

Ultimately, Singapore’s economic status is wedged within the margins of “wealthy” but not “wealthy enough”. Where money flows rapidly, it also disintegrates within the prompt spendings of a Singaporean lifestyle.

11/22/2025

Nguyen Lac Nghi

Leave a comment